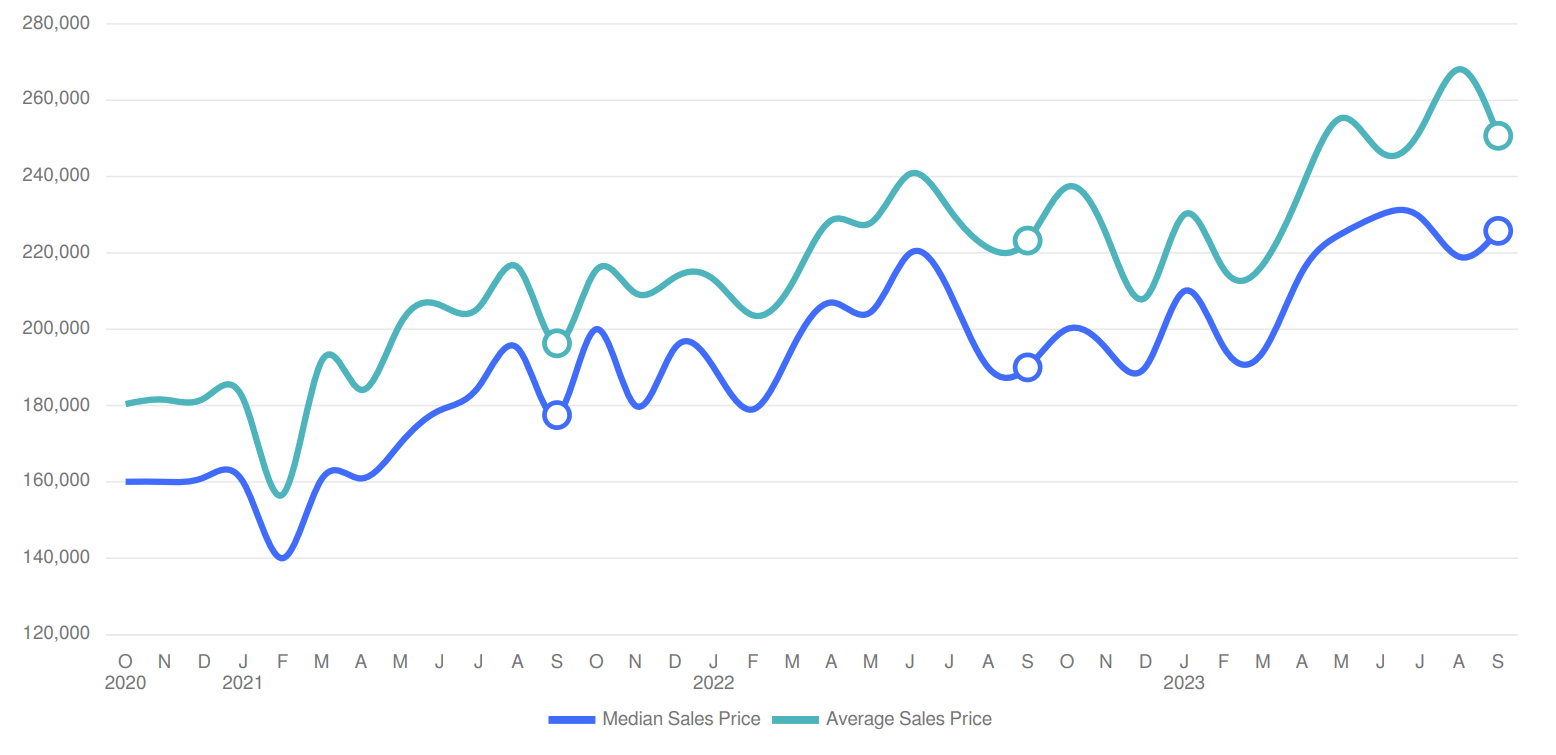

Average & Median Sales Price

The median sales price in September 2023 was $225,773, up 3.09% from $219,000 from the previous month and 18.83% higher than $190,000 from September 2022. The September 2023 median sales price was at its highest level compared to September 2022 and 2021. The average sales price in September 2023 was $250,684, down -6.50% from $268,100 from the previous month and 12.30% higher than $223,230 from September 2022. The September 2023 average sale price was at its highest level compared to September 2022 and 2021.

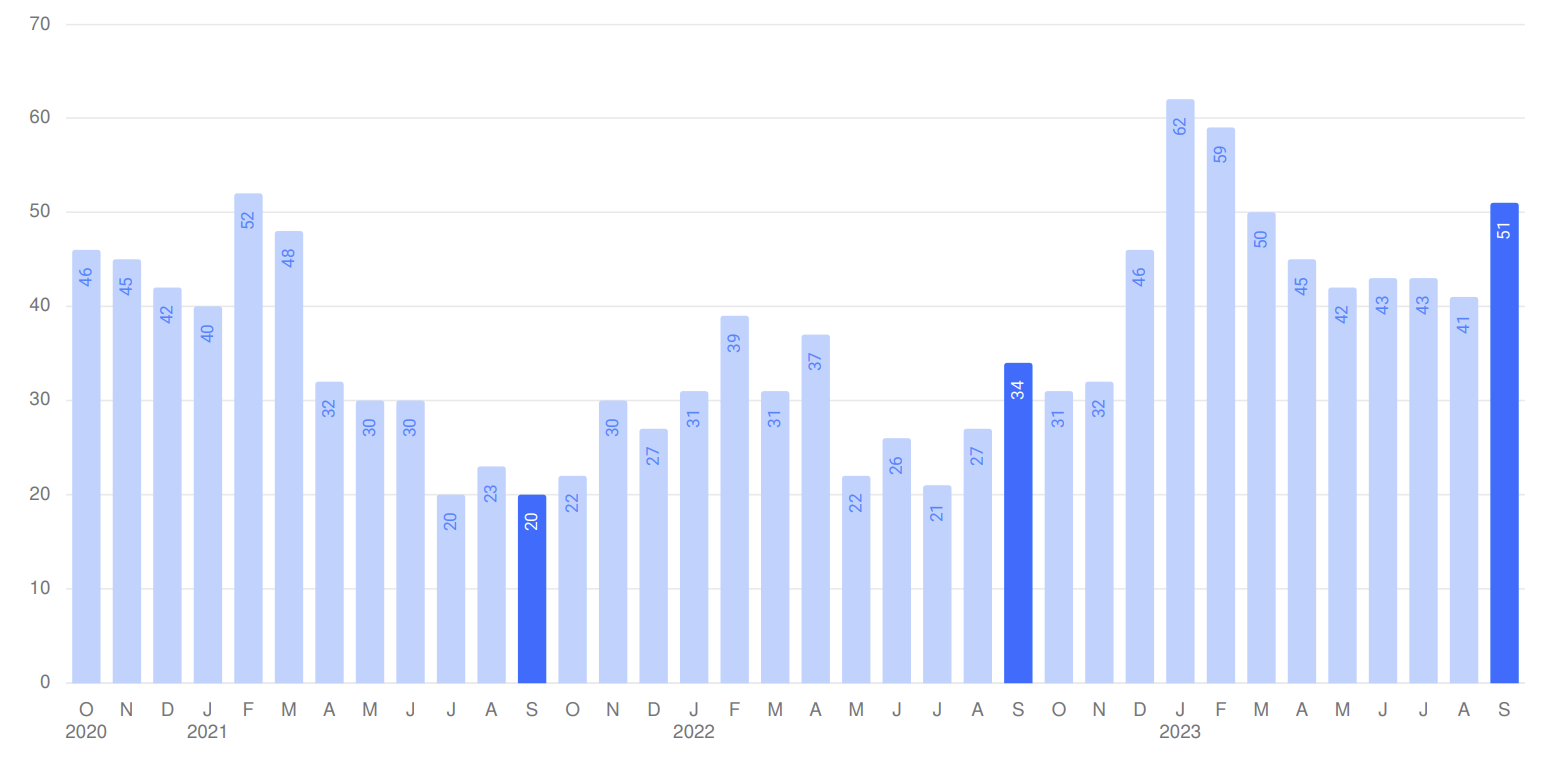

Average Days on Market

The average days on market (DOM) is the number of days a property is on the market before it sells. An upward trend in DOM tends to indicate a move towards a buyer’s market, a downward trend tends to indicate a move towards seller’s market. The DOM for September 2023 was 51 days, up 24.39% from 41 days from the previous month and 50.0% higher than 34 days from September 2022. The September 2023 DOM was at its highest level compared with September 2022 and 2021.

Average Sales Price per Square Foot

The average sales price per square foot is a more normalized indicator for the direction of property value. The sales price per square foot in September 2023 was $135,up 2.27% from $132 from the previous month and 14.41% higher than $118 from September 2022.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Ingredients

Ingredients

Seriously, one of the least expensive investments you can make has a huge impact. Lots of folks ask about should they paint or remodel their bathroom to attract buyers to their properties. Now if your walls are purple or your bathroom has shag carpet dated back to the 1970s, those items certainly need to be addressed. But, in most homes, the important things cost nothing at all. Cleaning = Free. Decluttering = Free. Organizing = Free. Bright and matching light bulbs have the most impact!

Seriously, one of the least expensive investments you can make has a huge impact. Lots of folks ask about should they paint or remodel their bathroom to attract buyers to their properties. Now if your walls are purple or your bathroom has shag carpet dated back to the 1970s, those items certainly need to be addressed. But, in most homes, the important things cost nothing at all. Cleaning = Free. Decluttering = Free. Organizing = Free. Bright and matching light bulbs have the most impact!